Spotting and Avoiding Scams

Trust is the number one reason why people fall for scams. Fear is the number one strategy used by scammers.

Most 'too-good-to-be-true' offers are scams. Below we offer information on how to recognize and avoid scams to keep you, and your finances, safe.

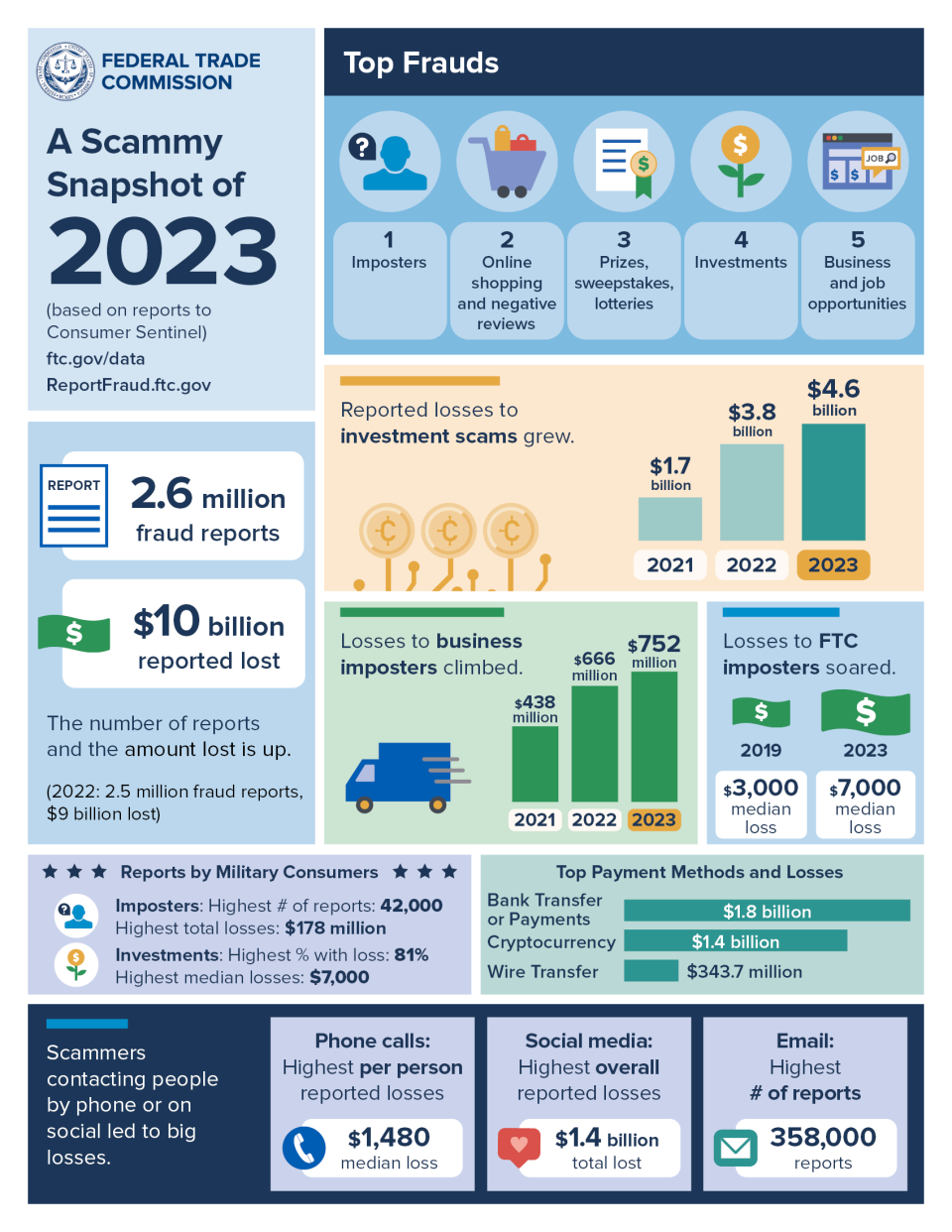

Anyone can be scammed. In 2022, 1 in 4 people said they lost money to a scam.

- People ages 20-29 reported losing money to fraud more often than people ages 70+.

- While younger people lost money 41% of the time, older adults’ lost money only 17%.

- However, when older people did lose money, they lost a significantly higher amount of money.

Techniques used by Scammers

- Truth Bias – exploiting the human tendency or assumption that others are telling the truth, especially when it’s repeated consistently.

- Foot in the Door – by getting you to commit to small commitments first, people want to remain consistent and are hard pressed to say no later after saying yes earlier. Scammers build momentum in this way.

- Financial vulnerability - Often predators target people who are seeking relief from financial stress.

Scammers are after your Personally Identifiable Information (PII)

- Credentials – SSN, birth certificate, driver’s license, financial accounts, usernames & passwords

- Attributes – name, phone number, address, license plate, date of birth

- Biometrics – fingerprints, photos, voice print

- Behaviors – spending habits, browsing activity, travel activity, geolocation, online quizzes

The more the scammer knows about you the easier it is to fool you. The more information publicly available online about you makes it easier for criminals to fool you.

Things only scammers will say

- “Act now!” That’s a scam. Scammers use pressure, so you don’t have time to think. But pressuring you to act now is always a sign of a scam. It’s also a reason to stop.

- “Only say what I tell you to say.” That’s a scam. The minute someone tells you to lie to anyone — including bank tellers or investment brokers — stop. It’s a scam.

- “Don’t trust anyone. They’re in on it.” That’s a scam. Scammers want to cut you off from anyone who might slow you down.

- “Do [this] or you’ll be arrested.” That’s a scam. Any threat like this is a lie. Nobody needs money or information to keep you out of jail, keep you from being deported, or avoid bigger fines. They’re all scams.

- “Don’t hang up.” That’s a scam. If someone wants to keep you on the phone while you go withdraw or transfer money, buy gift cards, or anything else they’re asking you to do: that’s a scammer. DO hang up.

And here’s a list of things that only scammers will tell you to do

- “Move your money to protect it” is a scam. Nobody legit will tell you to transfer or withdraw money from your bank or investment accounts. But scammers will.

- “Withdraw money and buy gold bars” is a scam. Always. Every time.

- “Withdraw cash and give it to [anyone]” is a scam. Doesn’t matter who they say: it’s a scam. Don’t give it to a courier, don’t deliver it anywhere, don’t send it. It’s a scam.

- “Buy gift cards” is a scam. There’s never a reason to pay for anything with a gift card. And once you share the PIN numbers on the back, your money’s as good as gone.

Other red flags

- If it’s too good to be true, it’s probably not true

- Someone that is pressuring you to get them money as quickly as possible

- High pressure sales tactics

- Fear tactics

- Requesting bank account and routing numbers

- Someone who doesn’t want you to discuss the phone call with a loved one

- A person posing as law enforcement or a government official

How to avoid scams

- Block unwanted calls and text messages. Take steps to block unwanted calls and to filter unwanted text messages.

- Don’t give your personal or financial information in response to a request that you didn’t expect. Honest organizations won’t call, email, or text to ask for your personal information, like your Social Security, bank account, or credit card numbers.

- If you get an email or text message from a company you do business with and you think it’s real, it’s still best not to click on any links. Instead, contact them using a website you know is trustworthy. Or look up their phone number. Don’t call a number they gave you or the number from your caller ID.

- Resist the pressure to act immediately. Honest businesses will give you time to make a decision. Anyone who pressures you to pay or give them your personal information is a scammer.

- Know how scammers tell you to pay. Never pay someone who insists that you can only pay with cryptocurrency, a wire transfer service like Western Union or MoneyGram, a payment app, or a gift card. And never deposit a check and send money back to someone.

- Stop and talk to someone you trust. Before you do anything else, tell someone — a friend, a family member, a neighbor — what happened. Talking about it could help you realize it’s a scam.

Resources:

https://www.identitytheft.gov/

https://www.lssmn.org/financialcounseling/tools-and-resources/avoid-scams

https://consumer.ftc.gov/features/identity-theft

https://www.usa.gov/identity-theft

https://www.irs.gov/identity-theft-central

https://consumer.ftc.gov/identity-theft-and-online-security/identity-theft

https://www.ag.state.mn.us/consumer/Publications/IdentityTheft.asp

Our Recent News